ON THIS PAGE

Stay Updated with latest in AI SEO

04 December 2025

Something caught my attention recently. More people are using ChatGPT to shop for wellness products, but nobody's really testing how intimate wellness brands actually show up in these AI-powered searches.

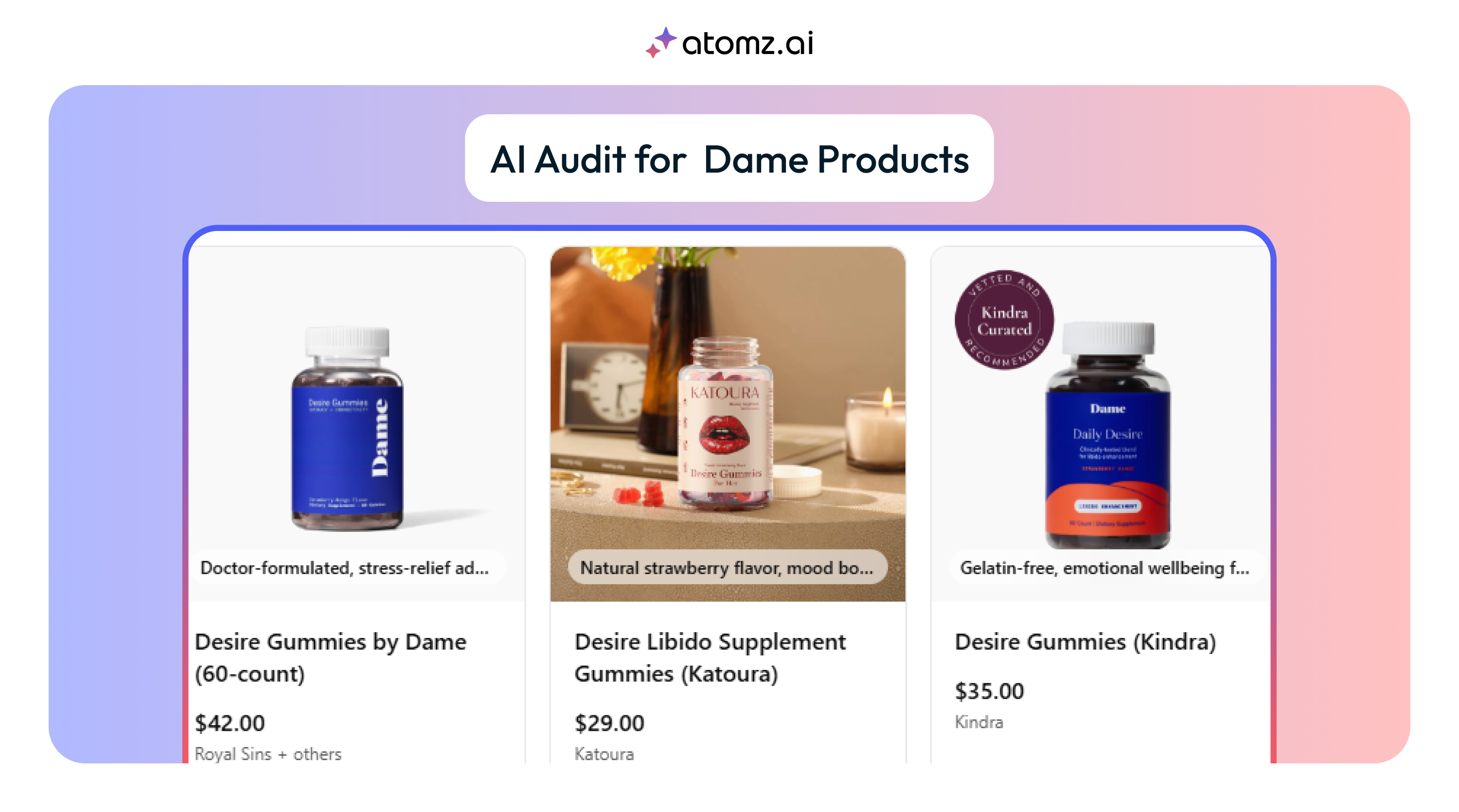

So I decided to run an experiment. I picked Dame Products, the science-backed intimate wellness brand known for design-forward products and inclusive messaging, and tested how visible they are when someone uses ChatGPT to find women's wellness products.

Dame Products appeared in only 3 out of 13 purchase scenarios I tested. Despite being a recognized leader in intimate wellness, they were completely absent from searches like "shop women's wellness products."

Before diving into the Dame Products results, you can check your brand's general AI readiness right now.

Test Your Brand's AI Visibility →

Takes 2 minutes. See how your brand performs across different AI systems.

Test how your brand performs across the complete AI discovery spectrum with these 13 strategic queries:

1. Category Authority (4 queries)

Tests: Do you own your product category in AI recommendations?

2. Product Specificity (4 queries)

Tests: Does AI recommend you for specific product attributes?

3. Competitive Positioning (1 query)

Tests: Do you appear when customers seek alternatives?

4. Subscription & Convenience (2 queries)

Tests: How does AI categorize your convenience offerings?

5. Commercial Intent (2 queries)

Tests: Do you capture purchase-ready shoppers with buying signals?

Scoring Your Results:

3 out of 13 queries (23% visibility)

Scoring approach: 8+ mentions = strong visibility | 4-7 = mixed results | under 4 = limited visibility

Here's what happened with each search:

Result:

Missing entirely

What appeared instead:

Saalt Menstrual Cup ($32.00), DIVA Cup Model 2 ($34.49), OrganiCup Menstrual Cup ($32.00)

My take:

Menstrual care brands dominate general women's wellness searches, with intimate wellness products absent from this broader category.

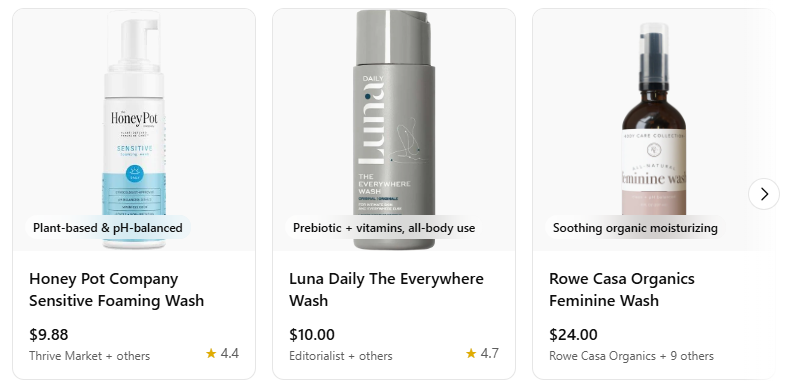

Result:

Missing entirely

What appeared instead:

Honey Pot Company Sensitive Foaming Wash ($9.88), Luna Daily The Everywhere Wash ($10.00), Rowe Casa Organics Feminine Wash ($24.00)

My take:

Intimate care searches focus on hygiene and pH-balancing products rather than pleasure/wellness items, showing category segmentation.

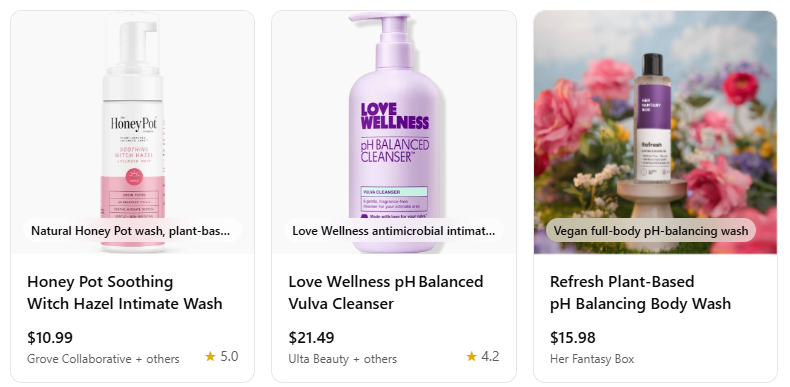

Result:

Missing entirely

What appeared instead:

Honey Pot Soothing Witch Hazel Intimate Wash ($10.99), Love Wellness pH Balanced Vulva Cleanser ($21.49), Refresh Plant-Based pH Balancing Body Wash ($15.98)

My take:

"Body-safe" searches return intimate hygiene products rather than intimate wellness devices, suggesting different AI categorization.

Result:

Missing entirely

What appeared instead:

Nature Made For Her Multivitamin ($15.29), MenoVital Menopause Support ($59.99), Love Wellness Intimate Skin Cleanser ($16.49)

My take:

Women's health searches prioritize vitamins, supplements, and basic intimate care over intimate wellness products.

Result:

Missing entirely

What appeared:

Good Clean Love Balance pH-Balanced Wipes ($8.99), Love Wellness pH Balanced Wipes ($52.75), SaltXo AllOver Aloes Wipes ($10.00)

My take:

Even "intimate wellness" searches return pH-balancing wipes and hygiene products rather than pleasure-focused items.

Result:

Missing entirely

What appeared:

Honey Girl Organics Organic Personal Lubricant ($26.95), Natalist 'The Lube' Fertility-Friendly Lubricant ($25.00)

My take:

Organic lubricant searches favor smaller, specialized organic brands over mainstream intimate wellness companies.

Result:

Missing entirely

What appeared:

Medicine Mama Organic Lube ($17.99), Mochi Melt Unflavored Water-Based Lube ($28.00)

My take:

Sensitive skin searches prioritize hypoallergenic and organic formulations from specialized brands.

Result:

Missing entirely

What appeared:

Foria Awaken Arousal Oil (with CBD) ($48.00), Sensuva ON Peppermint Arousal Oil ($19.90), ON Ice Buzzing & Cooling Arousal Oil ($242.99)

My take:

Arousal oil searches favor CBD and sensation-focused brands over broader intimate wellness companies.

Result:

Featured in a comprehensive list

What appeared:

Detailed comparison table listing Dame as: "Body-safe silicone, ergonomic designs, hands-free options, wearable tech ($69-$149) - Great for couples and solo use; innovation-focused like LELO but more gender-neutral"

My take:

Strong competitive positioning when directly compared to premium intimate wellness brands, highlighting innovation and design focus.

Result:

Missing entirely

What appeared:

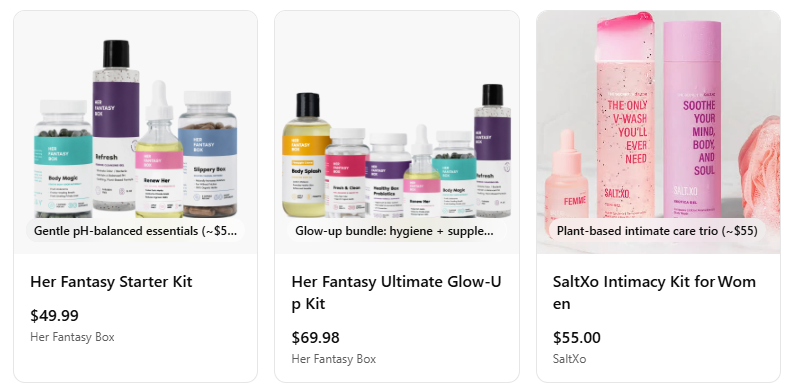

Her Fantasy Starter Kit ($49.99), Her Fantasy Ultimate Glow-Up Kit ($69.98)

My take:

Subscription box searches favor curated wellness kits over individual brand products, missing convenience-focused customers.

Result:

Featured in a comprehensive list

What appeared:

Detailed comparison table listing Dame as: "Couple kits with vibrators, lubes, and how-to guides ($75-$150) - Science-backed design, built for connection and comfort"

My take:

Good positioning in couples-focused searches, emphasizing science-backed design and relationship benefits.

Result:

Missing entirely

What appeared:

Her Fantasy Starter Kit ($49.99), Her Fantasy Ultimate Glow-Up Kit ($69.98), SaltXo Intimacy Kit for Women ($55.00)

My take:

General sexual wellness searches favor kit-based products and comprehensive collections over individual devices.

Result:

Featured prominently

What appeared:

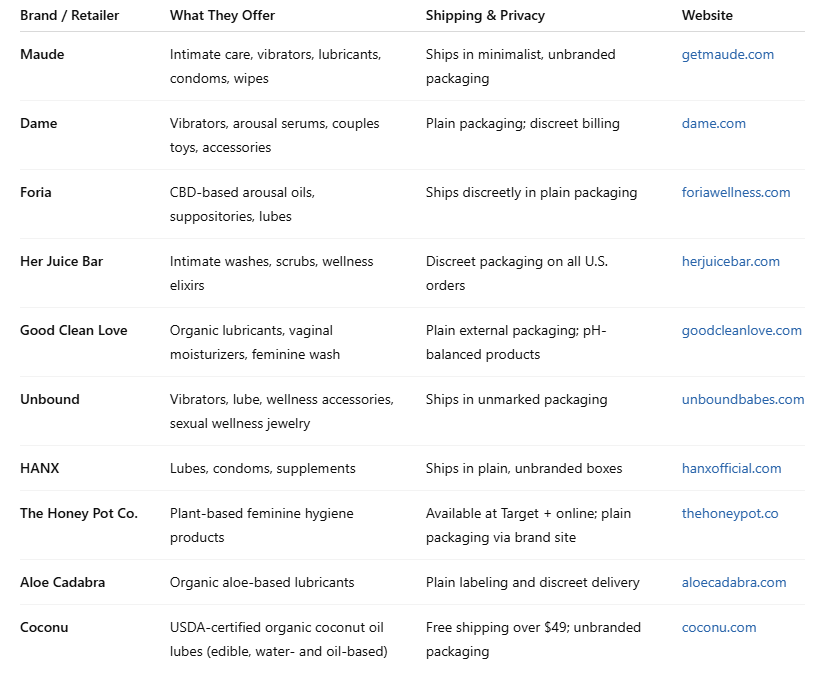

Comprehensive retailer list with Dame listed as: "Vibrators, arousal serums, couples toys, accessories - Plain packaging; discreet billing - dame.com"

My take:

Strong presence in "where to buy" searches, positioned alongside major intimate wellness retailers with clear value proposition.

The standout finding: Dame Products only appeared in 3 searches - all related to competitive positioning, couples products, or retailer listings. They were completely absent from category, product-specific, and general wellness searches.

Why this might be happening: Dame Products faces AI categorization challenges where intimate wellness is segmented away from broader women's health and wellness categories. Hygiene-focused brands dominate "intimate care" searches, while pleasure-focused products appear in more specific contexts.

Working theory: AI systems may categorize intimate wellness products separately from general wellness, limiting discovery for customers who don't use specific intimate product terminology.

The specialization challenge: Dame excels when searches specifically mention intimate wellness brands or couples products but struggles with broader category discovery and women's wellness positioning.

Category performance breakdown:

The category segmentation factor: Intimate wellness appears to be highly segmented in AI categorization, with hygiene products, pleasure products, and general wellness treated as separate categories.

Seeing similar patterns in your industry? Don't guess about your AI visibility.

Check Your Brand's AI Readiness →

See how your brand performs across multiple AI systems. Then manually test the 13-query framework above.

For specialized brands: Category specialization can limit AI discovery in broader wellness searches. You need structured product data that clearly connects intimate wellness to general women's health and wellness.

For sensitive product categories: AI systems may have conservative categorization for intimate products, requiring more specific optimization strategies to appear in relevant searches.

The positioning factor: How you position your products (wellness vs. pleasure vs. health) affects AI categorization significantly in sensitive categories.

Learn more about optimizing specialized products for AI discovery in our guide: Why Your DTC Brand Is Invisible to AI Search

Check your brand's baseline AI visibility. Start here →

Which categories are you missing from? Where do competitors appear instead of you?

Optimize your product information for AI systems. Check our LLM Audit Checklist for specific optimization steps.

Re-run tests monthly to track improvement and catch new patterns.

Based on this research, I've built several tools to help brands optimize for AI discovery:

• AI Readiness Scanner → Test your brand across multiple AI systems

• LLMs.txt Generator → Help AI systems understand your products

• Catalog Genius → Structure product data for better discovery

• AI Search Demo → See intelligent product discovery in action

Want your brand tested?

I'm building a research database of how brands appear in AI discovery systems.

Suggest a brand for analysis →

Testing method:

Fresh ChatGPT-4 sessions, purchase-intent queries, conducted August 6, 2025. This analysis examines publicly available AI responses for research purposes.

Study limitations:

Single AI platform (ChatGPT-4), point-in-time snapshot, purchase-intent queries only. Results may vary across different AI systems and time periods.

Tools used: AI readiness scanner, LLMs.txt generator, and catalog optimization agent for analyzing brand discoverability patterns.

© 2025 AI Brand Intelligence by Atomz. Forward freely, just keep this notice intact.

Streamline your workflow, achieve more

Richard Thomas

Create buying intent instantly

Create buying intent before customers search. 25%+ conversion lift guaranteed.

Why Prompts Matter

AI Search That Converts 3x Better

Get the latest in AI-powered search, UX trends, and eCommerce conversions—straight to your inbo

No spam. Just powerful insights.

👉 Join thousands of growth-focused brands.